(Zero Hedge)—Following the news of the Three Mile Island restart plans to power Microsoft’s AI data centers and the revival of Holtec’s Palisades nuclear plant in Michigan, Google CEO Sundar Pichai revealed in an interview with Nikkei Asia in Tokyo on Thursday that the tech giant is exploring the use of nuclear energy as a potential ‘green’ source to power its data centers.

“For the first time in our history, we have this one piece of underlying technology which cuts across everything we do today,” Pichai said of generative AI. He said, “I think the opportunity to do well here is something we are leaning into.”

Three years ago, Google released plans to achieve net-zero emissions by 2030. However, the proliferation of AI data centers has led to a surge in the big tech’s power consumption, which, in return, its greenhouse gas emissions in 2023 jumped 48% more than in 2019 on a carbon-dioxide equivalent basis.

Behind the scenes, Google is likely scrambling to secure green energy and curb emissions as 2030 quickly approaches.

“It was a very ambitious target,” Pichai said of the net-zero emissions targets, “and we will still be working very ambitiously towards it. Obviously, the trajectory of AI investments has added to the scale of the task needed.”

He continued, “We are now looking at additional investments, such as solar, and evaluating technologies like small modular nuclear reactors, etc.”

Nikkei noted that Pichai wasn’t clear on where Google might start sourcing nuclear power. A bulk of that power could come from reviving older nuclear power plants. This is exactly what Microsoft did when it signed a power agreement contract with dormant Three Mile Island on the Susquehanna River near Harrisburg, Pennsylvania.

Recall that just last week, we wrote that Sam Altman-backed Nuclear SMR company Oklo announced it had finalized an agreement with the Department of Energy to advance the next phase of the SMR at the Idaho National Lab. And days ago, the Biden administration closed a $1.52 billion loan with Holtec’s Palisades nuclear plant in Michigan to revive it.

Sachem Cove Partners Chief Investment Officer Michael Alkin told Bloomberg shortly after the Microsoft-Three Mile Island deal, “It’s a wake-up call to those that have not been paying attention,” adding that demand already outstrips the supply of uranium and the restart of Three Mile Island “takes that to a bit of a different level.”

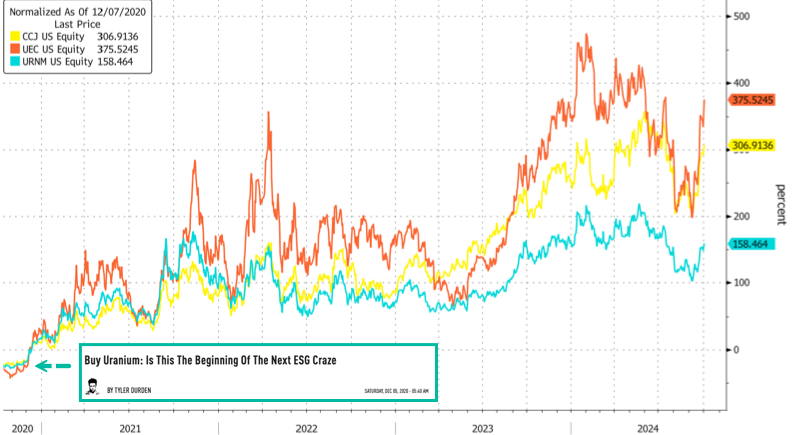

Also, the funding markets are becoming more receptive to nuclear deals as governments and big tech understand the only way to hit ambitious net zero goals is not with solar and wind but with nuclear power. In late December 2020, we outlined to readers that this would happen in a note titled “Buy Uranium: Is This The Beginning Of The Next ESG Craze?”

Furthermore, here’s Goldman’s latest note on uranium prices, which are only expected to “stairstep” higher over time.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.